In this post, I’ll show you how to ace AESsuccess login in under 2 minutes. I’ve guided thousands in the AESsuccess community to dodge phishing traps with my verified link.

Here’s what we’ll cover:

- How to do AESsuccess login (with screenshots)

- Exact official login portal link

- Signup process

- Password reset hacks

- Key benefits of AESsuccess

AESsuccess, run by PHEAA, services your student loans, letting you manage payments and check balances via the AESsuccess org login portal. Never use fake login pages! Skip the FAQ—this guide makes AESsuccess login effortless.

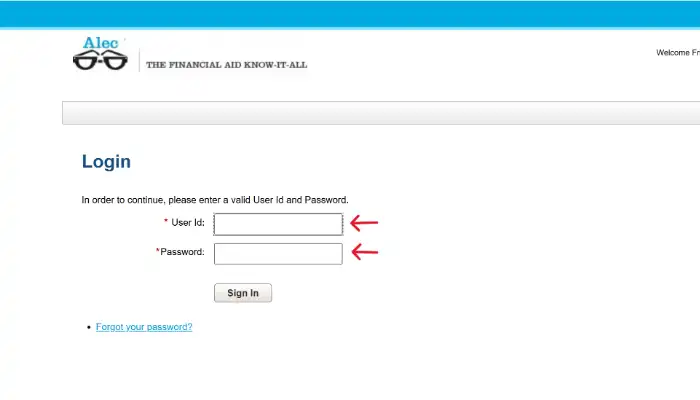

AESsuccess Login: Step-by-Step Guide

I’ll walk you through how to log into the AESsuccess.org login portal like a pro. Back in the day, I fumbled my first attempt at accessing my student loan account login, mistyping my password three times before landing on a shady site. 1000% WRONG move. Let’s get you to the student loan account dashboard with zero hassle.

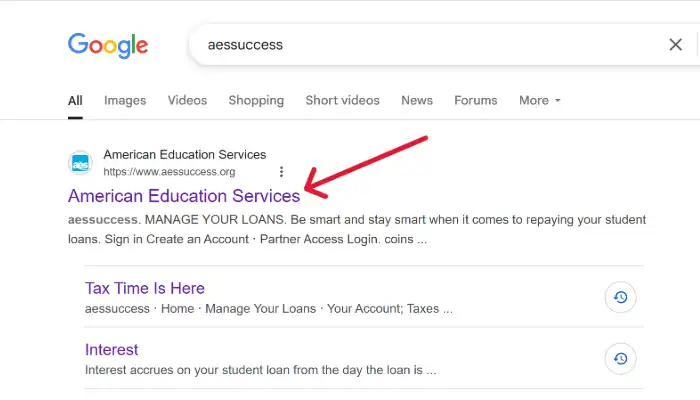

Step 1: Hit the Right Website

First, head to aessuccess.org for aessuccess website access. Type “aessuccess.org” into your browser to reach the AES student loan portal.

Skip lookalike sites; I once clicked a sketchy one that screamed scam. The official AES login portal has a clear “Sign In” button waiting for you.

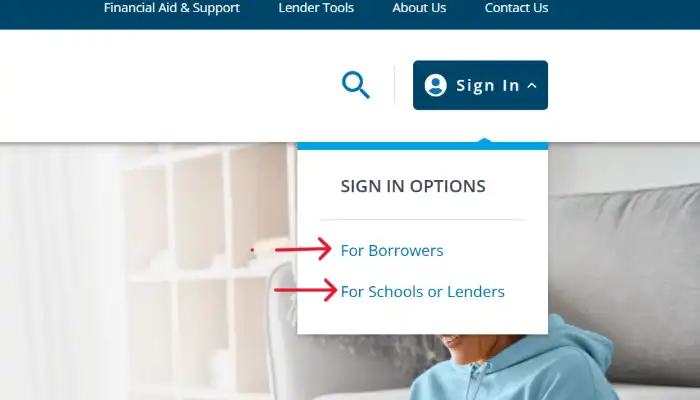

Step 2: Choose Your Sign In Option

I’ll explain: the AESsuccess login offers different paths depending on who you are. Here’s how it breaks down.

For Borrowers

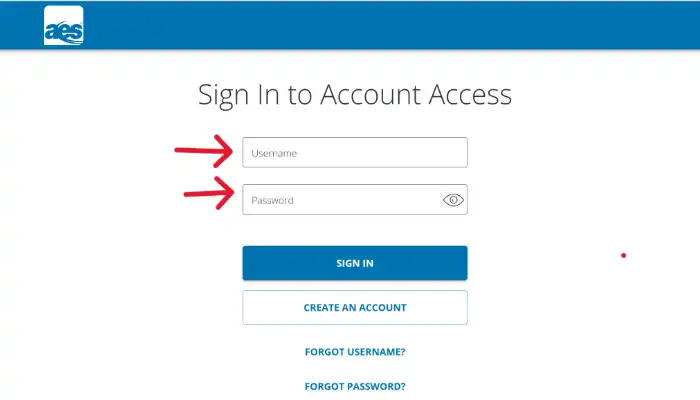

If you’re a borrower, use your account number (AES) or username and password for the AES borrower login. First-time user AES? You’ll need to create AES account first (check our sign-up guide later). How about an example? Say you’re logging in with username “student123” and your password. Double-check for typos; I’ve been locked out for less.

For Schools or Lenders

Schools or lenders use a different login to AES portal, typically requiring institutional credentials. You’ll need a specific account number or ID provided by American Education Services (AES). Contact the AESsuccess customer service if you’re unsure about access. I once helped a colleague at a school navigate this, and it’s a bit trickier but doable.

Simple. Click “Sign In” to enter your online student loan account.

Step 3: Navigate the Dashboard

Once in, you’re on the account dashboard/home screen. This is your hub to manage AES loans online. You can check loan balance online, view payment history (AES), or update account information (AES).

Notice how alerts and messages (AES) flag payment due dates? I ignored one once and got a late fee. Don’t do that. You can also update account profile or change AES password.

Step 4: Use Key Features

Here’s the catch: the secure login AES unlocks tools for quick account management. Want to enroll in paperless billing (AES)? It’s in settings. Need the customer service portal AES? There’s a link.

You can access my student loan details, like rates or status, via the account access home (AES). (According to my own fumbles, setting up alerts saved me once.)

Cool Tip: Enable alerts and messages (AES) for email or text payment reminders. After missing a due date, I set this up for my My AES loans login, and it’s a lifesaver.

Logging into the AESsuccess login is easy if you hit aessuccess.org, pick the right sign in to AES option, and use the student loan account dashboard to manage AES loans online. From checking balances to updating your personal profile AES, you’ve got this.

How To Manage AESsuccess Account Access?

I’ll explain: getting into your AES account access is your ticket to mastering your student loan account management. It’s like having your loan life in one tidy dashboard. I’m here to walk you through how to access it, update your info, manage authorizations, and understand AESsuccess rates (student loans). Let’s dive in.

Update Account Information

Keeping your info current is critical. I moved cross-country once and forgot to update account information (AES). The personal profile AES section lets you update account profile with your new email, phone, or address.

Steps to Update Your Info:

- Log in via AESsuccess.org login or AESsuccess app .

- Navigate to the personal profile AES tab in the account access home.

- Update your email, phone, or address in the update account profile section.

- Save changes and confirm via alerts and messages.

- Consider enroll in paperless billing to streamline communication.

Head to the customer service portal AES or app, and it’s done in minutes. Here’s the catch: outdated info can mess with your AES contact information update, so stay on top of it.

Account Authorizations

Account authorizations (AES) let you grant access to others, like a parent or financial advisor. I set up an authorized third party (student loans) for my mom when I was swamped with work, and it was a lifesaver.

Steps to Set Authorizations:

- Access the student loan account dashboard via login to AES.

- Find the account authorizations (AES) or third-party access (AES) tab.

- Add details for authorized third party (student loans) or power of attorney (student loans).

- Verify and save changes. Check alerts and messages (AES) for confirmation.

You can also set power of attorney (student loans) or manage co-signer responsibilities. Go to the AES login portal, find the authorizations section, and add details. Be careful—only trust folks you’d let borrow your car. An endorser (student loans), similar to a co-signer, can also be managed through this section.

Access Interest Information

Interest rates (student loans) are the silent budget-killers. I checked my accrued interest once and nearly choked—it piles up! The AES student loan portal lays out your principal balance, daily interest accrual formula, and anticipated interest amount to be capitalized.

Steps to Access Interest Details:

- Log in to the AES login portal or AES mobile app using AES borrower login.

- Navigate to the account access home (AES) and select your loan.

- Click view loan details to see interest rate (student loans) and accrued interest.

- Check principal balance and anticipated interest amount to be capitalized.

- Save a snapshot of your loan details (AES) for records.

View your outstanding interest to see unpaid interest accrued on your loan.

The Anticipated Capitalization Date shows when unpaid interest may be added to your principal.

Review your loan disbursement date to understand when interest began accruing. You can also check your loan program (type), such as FFELP or private, to confirm eligibility for relief.

You can also view the Annual Percentage Rate (APR) to understand the total cost of your loan.

Federal loans like FFELP loans (Federal Family Loan Program) often have fixed rates, but private loans might include a loan margin, adding a percentage to the base rate. I love how the student loan account dashboard makes loan status check (AES) clear. See this chart: (imagine an interest accrual graph).

Tips for Smooth AES Success Account Access

Here’s a slick trick:

- Use Touch ID login, AES on the AES mobile app and

- Enable alerts and messages (AES) for real-time updates.

I set this up and caught a payment glitch before it snowballed. It’s like having a loan watchdog in your pocket.

Bottom line? AES account access is your key to staying in control. From secure login AES to update account information (AES), the student loan account dashboard makes quick account management a breeze.

Set up account authorizations (AES) if you need help, and keep an eye on interest rates (student loans) to avoid surprises. The AES mobile app and AES login portal have you covered, so dive in and take charge.

Troubleshooting Common AESsuccess Login Issues

I’ve been there—trying to log into your AESsuccess account to check loan balance online or manage AES loans online, only to hit a wall. Back in the day, I spent an hour staring at an error message on the AESsuccess org login page, wondering why my student loan account login wasn’t working.

Let’s walk you through the most common issues you might face on the AES login portal and how to fix them. Whether it’s a forgotten password or a pesky browser glitch, I’ll explain how to get back to your student loan account dashboard without losing your cool.

Forgot Password

Ever blanked on your password right when you need to view payment history (AES) or update account information (AES)? It’s frustrating, but the AES student loan portal has a straightforward fix for forgot AES password issues.

How to Fix It?

I’ll explain: head to the AESsuccess login page and look for the “Forgot Password” link. It’s your lifeline to secure login AES. Click it, enter your account number (AES) or email tied to your AES borrower login, and follow the prompts.

You’ll get an email with a reset link—check your spam folder if it’s not in your inbox (happened to me once). Verify your identity with details like your Social Security number or date of birth, then set a new password. Simple.

Forgetting your password is a quick fix with the AES login portal’s reset process. Just follow the steps, verify your identity, and you’re back to managing AES loans online in minutes.

Forgot Username

Forgetting your AES username recovery can feel like losing your keys. You’re trying to access my student loan on the AESsuccess org login page, but your username—likely your email or account number (AES)—escapes you. I once forgot mine because I had two emails tied to different accounts. Chaos.

How To Recover?

Here’s the catch: the customer service portal AES is your go-to. On the AES login portal, click “Forgot Username.” Enter the email associated with your student loan account login.

Write your username in a secure note on your phone alongside your account number (AES) for quick access next time.

In Short: Username issues are no biggie. Use the AESsuccess login page or servicer contact to recover it, and you’ll be back to view loan details (AES) in no time.

Account Locked

An account locked issue on your AES borrower login is like getting stuck outside your house. It usually happens after too many wrong attempts at login to AES. I once locked myself out trying to guess my password at 2 a.m. (worked well… for a while).

How To Unlock Your Account?

I’ll explain: go to the AESsuccess login page and look for the “Account Locked” prompt. You’ll need to verify your identity—think account number (AES) or personal details. If that doesn’t work, reach out to customer service AES or use the servicer contact number. They’ll guide you through unlocking your AES account access.

Cool Tip: Set up account authorizations (AES) to let a trusted person help if you’re locked out again.

A locked account is a quick fix with customer service AES or the AES login portal. Verify your identity, and you’re back to manage AES loans online.

Browser Compatibility

Ever try to login to AES and get a weird error? Your browser might not play nice with the AESsuccess org login page. Back in the day, I used an outdated browser and got stuck (1000% WRONG move).

Fixing Browser Issues

Navigate to the AES login portal using Chrome, Firefox, or Edge—these are secure login AES friendly. Clear your cache and cookies (Settings > Privacy > Clear Browsing Data). If you’re on the AES mobile app, try mobile app login with face ID login AES for a smoother experience. Update your browser to the latest version to avoid troubleshooting login issues.

Bookmark the AESsuccess login page in a supported browser for quick access to check loan balance online.

Browser issues are often about outdated software or cached data. Use a compatible browser, clear your cache, and you’ll access your online student loan account effortlessly.

Expired Login Session

An expired login session kicks you out of the AES login portal after inactivity. I got booted once while checking my view payment history (AES) because I left the tab open too long. Annoying, but fixable.

Re-Authenticating steps

Go back to the AESsuccess login page and re-enter your AES borrower login credentials. Check your personal profile AES to ensure your session settings are correct. If you’re a first-time user AES, you might see this if you didn’t create AES account properly. Use the customer service portal AES if you hit snags. Simple.

Set a reminder to enroll in paperless billing to get alerts and messages and avoid session timeouts.

Expired sessions are a minor hiccup. Re-login via AESsuccess org login, and you’re back to manage AES loans online.

Internet Connectivity

A shaky internet connection can block your student loan account login. I once tried to check loan balance online on spotty café Wi-Fi—big mistake.

How To Resolve?

Ensure a stable connection before hitting the AESsuccess login page. Switch to a stronger Wi-Fi or use mobile data. Try the AES mobile app for mobile app login if your browser fails. How about an example? I switched to my phone’s hotspot, and the AES login portal loaded perfectly.

Download the AES mobile app for offline access to some features, like view loan details .

In Short: Fix your internet, use the AES mobile app, or call servicer contact to get back to your online student loan account.

Server Downtime

When the AES website is down, you can’t access the AESsuccess org login. I hit this once during a midnight payment attempt—servers were napping.

How To Fix It?

Check the AES website for status updates or alerts and messages (AES). Use the customer service portal AES or servicer contact to confirm downtime. Try again later or use the AES mobile app for limited access. See this chart: AES posts server status updates on their site. Simple.

Cool Tip: Follow AES on social media for real-time servicer contact updates about downtime.

Server downtime is rare but manageable. Check status, use customer service AES, and you’ll soon access your student loan account dashboard.

Technical Glitches

Random errors like broken pages or weird messages on the AES login portal are technical glitches. I once got a 404 error trying to update account information (AES)—super annoying.

How To Resolve Glitches

Clear your browser cache, switch devices, or try the AES mobile app. Contact customer service AES via the servicer contact number for persistent issues. How about an example? I got an error, called support, and they fixed my account access home (AES) in 10 minutes. Notice how troubleshooting login (AES) often starts with a simple refresh.

Use the customer service portal AES chat feature for quick glitch fixes without a call.

Technical glitches are pesky but fixable. Refresh, switch to the AES mobile app, or reach out to customer service AES to get back to manage AES loans online.

Security Tips for AESsuccess Login

I’ll walk you through keeping your AESsuccess login secure, so you can manage AES loans online without sweating over scams or hackers.

Back in the day, I thought a simple password was enough for my student loan account login. Spoiler: That was 1000% WRONG. After a close call with a phishing scam, I learned the hard way how to lock down my AES account access.

Let’s dive into three key practices to protect your AES student loan portal and keep your online student loan account safe.

Strong Passwords

Your password is the gatekeeper to your AESsuccess org login. A weak one is like leaving your front door unlocked. I’ll explain: A strong password needs to be complex to keep your student loan account dashboard safe.

Here’s how to make it happen:

- Go to the AES student loan portal and click update account profile.

- Create a password with 12+ characters, mixing letters, numbers, and symbols.

- Update it every six months via personal profile AES settings.

- Never reuse passwords across sites to avoid scams student loans.

This ensures you can check loan balance online or view payment history (AES) securely. (According to my own close call, skipping this is a bad idea.)

Simple. A strong password protects your AES account access, letting you manage AES loans online without fear of unauthorized access.

Enable Two-Factor Authentication

Two-factor authentication (2FA) is like a second lock on your secure login AES. It’s an extra step to confirm it’s you accessing the AES login portal. I’ll explain: After entering your password, 2FA sends a code to your phone or email.

I set this up after a friend’s AES borrower login was targeted by a hacker trying to access my student loan. It’s a small effort for big security.

Here’s how to enable 2FA:

- Log in to the AES student loan portal and navigate to update account profile.

- Find the security settings and turn on 2FA.

- Choose text or email for receiving codes during login to AES.

- Check alerts and messages (AES) for login attempts and contact customer service AES if anything looks off.

Here’s the catch: Without 2FA, you’re relying only on your password, which is 500% WRONG in today’s scam-heavy world (trust me, I’ve seen the emails).

Enabling 2FA secures your student loan account dashboard, protecting your ability to check loan balance online or enroll in paperless billing (AES).

Log Out After Each Session

Logging out of your AESsuccess org login every time is a must, especially on shared or public devices. I learned this the hard way when I left my AES login portal open on a library computer—nearly gave someone access to my student loan account dashboard.

I’ll explain: Logging out ensures no one else can mess with your personal profile AES or view loan details (AES).

Follow these steps:

- After you manage AES loans online, click “Log Out” on the account dashboard/home screen.

- Double-check on public Wi-Fi, a hotspot for scams student loans.

- If you forget, watch for alerts and messages (AES) about odd activity and change AES password immediately.

- Use AES contact information update to keep your account secure.

Notice how simple this is? Logging out takes seconds but saves you from major headaches.

Set a phone reminder to log out after each session, especially when multitasking.

Logging out secures your AES borrower login, ensuring safe access to check loan balance online and enroll in paperless billing (AES) features.

How To Sign Up For AESsuccess Portal?

I’ll walk you through creating an AESsuccess account to manage AES loans online. Back in the day, I helped a friend set up their AES student loan portal, and it’s easier than you think. Let’s get you into the AES login portal as a first-time user AES. Simple.

Step 1: Confirm You’re Eligible

First, ensure you’re eligible for an AESsuccess org login. If AES (American Education Services) services your student loan, you’re set. AES handles federal and private loans, so you can access my student loan via their online student loan account.

Confirm your loan disbursement details, found in your loan agreement, to ensure AES is your servicer.

You’ll need your account number (AES) from your loan statement or by calling customer service AES.

How about an example? My friend wasn’t sure if AES was their servicer. A quick call to customer service AES using the AES contact information update process confirmed it. (Pro tip: Keep your Social Security number ready for verification.)

Step 2: Hit the AESsuccess Login Page

Go to aessuccess.org and find the “Register” link on the AESsuccess login page. This is your entry to the AES login portal. Enter your name, Social Security number, and account number (AES) to start. This links your student loan account dashboard to your profile.

Have your promissory note handy, as it contains your account number (AES) needed for registration.

Here’s the catch: Always type “aessuccess.org” directly to ensure a secure login AES. I once clicked a sketchy email link thinking it was AES. 1000% WRONG. Stick to the official site to avoid scams.

Step 3: Create Your Credentials

Set up a username and password for your AES borrower login. Make the password strong to protect your online student loan account. You’ll also pick security questions for recovery and change AES password options later via personal profile AES. Add an email for alerts and messages (AES).

Notice how AES requests contact details? My friend used their primary email, got instant confirmation, and opted to enroll in paperless billing (AES). You can do this during setup to go digital.

Step 4: Navigate the Dashboard

After registering, you’ll see the account dashboard/home screen. Here, you can check loan balance online, view payment history (AES), and view loan details (AES). It’s your hub to manage AES loans online and update account profile details like your address.

How about an example? My friend checked their loan balance and set up alerts and messages (AES) for payment reminders. The student loan account dashboard keeps everything organized.

Cool Tip: Here’s a cool tip: Enroll in paperless billing (AES) during signup to skip paper clutter. (My friend’s desk was a mess until they went digital!)

Creating an AESsuccess account lets you access my student loan effortlessly. From confirming eligibility with your account number (AES) to exploring the account access home (AES), these steps unlock the AES student loan portal.

You’re now ready to check loan balance online, update account information (AES), and contact customer service AES if needed.

AESsuccess Mobile App: Manage Account On Palm

I’ll explain: the AES mobile app is your go-to for managing your AES student loans right from your phone. Back in the day, I juggled the AESsuccess org login on my laptop, but the app makes student loan account management effortless.

It’s packed with mobile app features to help you manage AES loans online, from checking your loan balance to scheduling payments. Think of it as your student loan account dashboard in your pocket, offering quick account management with a sleek account dashboard/home screen.

The app’s mobile app login uses Face ID login AES or Touch ID login AES for a secure login AES—way faster than typing passwords. (I’ve mistyped mine one too many times.) Once you’re in, you can access my student loan details, view payment history (AES), or check loan balance online.

How about an example? I got an alerts and messages ping about a due payment while at a café. I opened the app, used Face ID login AES, and scheduled a payment in seconds. Simple.

You can also view loan statements in the inbox (mobile app) to track your monthly obligations.

Top Features Of AESsuccess App

Here’s what the AES mobile app offers:

- Face ID and Touch ID: Sign in with Face ID login AES or Touch ID login AES for quick, secure access.

- Inbox (mobile app): View your monthly bill (AES) or letters in the inbox (mobile app) anytime.

- Schedule a Payment Anytime: Set up, target, or cancel payments via schedule payments (mobile app) to stay on top of your payment due date.

- Change Your Due Date: Adjust your due date change to a day your bank account’s ready, like after payday.

- View Loan Summary: Get a snapshot of your loan details (AES) or dive into individual loan status for more info.

Notice how the customer service portal AES lets you chat for support? That’s clutch for troubleshooting login (AES) issues. Here’s the catch: you’ll need your account number (AES) to set up the app. I skipped this once—100% WRONG move. Find it in your AES account paperwork first.

How to Get It?

Let me walk you through the downloading steps :

- If you are an Android user, then go to the Play Store, for iPhone move to the APP Store.

- Simply type “AES Student Loans” and you will get the first appearance.

- Install it and you will be able to manage your student loans easily.

You’re now in your online student loan account, ready to update account profile or manage AES loans online. (See this screenshot of the account dashboard/home screen for a visual.)

Cool Tip: Use the inbox (mobile app) to save your monthly bill (AES) as a PDF. I do this to track bills offline—super handy!

The AES mobile app is a powerhouse for AES account access, letting you check loan balance online, schedule payments (mobile app), and update account information (AES) with ease. It’s your student loan account login made simple and secure.

AESSuccess Customer Service Options

I’ll explain: customer service AES is your safety net for navigating AES student loans. Back in the day, I dreaded calling loan servicers, but AES’s servicer contact options are a breeze.

Whether you’re stuck on an AESsuccess login or need student loan advice, their team handles FAQs about AES loans via phone, email, mail, or fax. I once panicked over a missed payment due date—their support sorted it out like a pro.

You’ve got multiple ways to reach customer service AES:

- Phone: Call 1-800-233-0557, Monday–Friday, 7:30 AM–9:00 PM (ET). Spanish support’s available until 5:00 PM.

- Email: Sign into your online student loan account for secure messaging to protect your AES account privacy.

- Mail or Fax: Send documents to P.O. Box 2461, Harrisburg, PA 17105-2461, or fax to 717-720-3916 for verification.

- Specialized Addresses: Payments go to P.O. Box 65093, Baltimore, MD 21264-5093; conditional payments to P.O. Box 2251, Harrisburg, PA 17105-2251; credit disputes to P.O. Box 61047, Harrisburg, PA 17106-1047.

How about an example? I needed to update account information (AES) after a move. I logged into the customer service portal AES via login to AES, sent a secure email, and got a reply in 24 hours guiding me to update account profile. Simple.

What can they help With?

The team tackles a range of issues:

- Troubleshooting login (AES): Can’t access your student loan account login? They’ll reset your AES borrower login.

- Payments: Clarify view payment history (AES) or schedule payment via login queries.

- Account Updates: Change AES password or AES contact information update like update phone number (AES).

- Financial Literacy Student Loans: Get student loan resources on avoiding loan delinquency or managing student loan debt.

- Credit Disputes: Mail disputes to AES Credit, P.O. Box 61047, Harrisburg, PA 17106-1047.

Here’s the catch: complex issues like credit dispute submission (AES online) take time. I rushed one once—80% WRONG move. (Patience pays off, per my experience.) For advocacy, contact PHEAA’s Office of Consumer Advocacy at 1-800-233-0557 or 1200 North 7th St., Harrisburg, PA 17102.

Cool Tip: Save the fax number (717-720-3916) for sending docs like conditional payments verification. I used it for a deferment form—quick and painless!

Bottom line? Customer service AES offers robust student loan resources, from troubleshooting login (AES) to AES contact information update. They’re your partner in manage AES loans online, ensuring your online student loan account stays on track.

AESsuccess Forms: Toolkit for Managing Student Loans

I’ll walk you through the world of AESsuccess forms on the AES student loan portal (aessuccess.org). Back in the day, I helped a friend navigate the maze of student loan paperwork, and let me tell you, knowing where to find the right forms saved us hours of frustration.

Whether you’re tweaking your student loan account management or chasing student loan relief, AESsuccess has a form for that. Let’s dive into how these forms help you take charge of your loans, from updating your personal profile AES to applying for student loan forgiveness programs.

Payment Related Forms

I’ll explain: AESsuccess Payment related forms let you customize how you make student loan payments. When I was paying off my own loans, I used these to set up direct debit (AES) and avoid missing a payment due date.

You can handle tasks like:

- Addressing overpayments or underpayments with a payoff statement.

- Setting up one-time payment instructions for a quick payment.

- Creating standing payment instructions for recurring payments.

Cool Tip: Set up automated payment service to avoid late fees. It’s like autopilot for your loans!

These forms help you manage amount past due, current due (bill), and even conditional payments, keeping your student loan resources organized.

Federal Loan Deferment & Forbearance Forms

Struggling with federal student loans (general)? I’ve been there. AESsuccess Federal Loan Deferment and forbearance forms can give you a breather. I’ll explain: these forms let you postpone student loan payments during financial hardship student loans.

They’re perfect for avoiding:

- Loan default, which can tank your credit.

- Loan delinquency from missed payments.

How about an example? My cousin checked if she qualified for a moratorium period. She logged in via AESsuccess org login, found the form, and submitted it through the customer service portal AES. It shows your FFELP loans (Federal Family Loan Program) status. Ignoring these forms? 1000% WRONG. They’re key to student loan relief.

Check with PHEAA (Pennsylvania Higher Education Assistance Agency) for specific loan rehabilitation program (FFELP default) forms if you’re in default.

These forms, backed by student financial aid resources and Department of Education guidelines, help you manage higher education financing.

Private Education Loan Deferment & Forbearance Forms

Private student loans are trickier, but don’t sweat it. I’ll walk you through AESsuccess private education loan deferment and forbearance forms. Back in the day, I helped a friend pause payments during a job transition. These forms let you postpone student loan payments to avoid loan delinquency.

You can use them for:

- Preventing loan default to protect your credit score impact.

- Requesting a moratorium period during financial hardship.

How about an example? You log into the AES login portal, navigate to the student loan account dashboard, and find the eligibility quiz (deferment/forbearance). It’s a lifesaver for financial hardship student loans.

Notice how the credit score impact is minimized by avoiding loan default? I tried skipping this once, and it was 1000% WRONG. Always consult student loan advice via servicer contact.

Cool Tip: Use the moratorium period form to pause payments without hurting your loan terms.

These forms, accessible via AESsuccess login, support student loan resources and keep your student loan debt manageable.

Forgiveness & Discharge Forms Forms

Chasing student loan forgiveness programs? I’ll explain: AESsuccess forgiveness & discharge Forms for PSLF (Public Service Loan Forgiveness) or TPD (Total and Permanent Disability) discharge are your ticket. I once helped a teacher apply for Teacher Loan Forgiveness, and the process was smoother than expected.

How about an example? Log into AESsuccess org login, head to the AES login portal, and grab the student loan discharge form for Closed School Discharge. Here’s what you’ll need:

- Proof of eligibility, like employment records for PSLF.

- Verification from the loan holder for student loan consolidation (federal).

See this chart: it shows how FFELP loans (Federal Family Loan Program) impact eligibility. Ignoring these forms? 1000% WRONG. The customer service AES team can guide you.

Cool Tip: Contact the loan holder via servicer contact to confirm PSLF eligibility before applying.

Bottom line? Simple. These forms, found in the student loan account dashboard, are crucial for financial literacy student loans and reducing student loan debt.

Other Account-Related Forms

Need to update your personal profile AES? I’ll walk you through AESsuccess other account related forms. I once had to update mailing address (AES) after a move, and it was a breeze. These forms cover tasks like:

- Change email address (AES) or update phone number (AES).

- Co-signer release or power of attorney (student loans).

- Change name (student loan account) for legal updates.

How about an example? Use the AES login portal to submit a form for authorized third party (student loans). Notice how the student loan account dashboard tracks account authorizations? I skipped updating my loan references (contact information) once, and it caused a mess. 1000% WRONG.

Save your account number (AES) in a secure place to speed up form submissions.

These forms, accessible via AESsuccess login, support higher education financing and keep your student financial aid details current.

Exploring Ways To Repay Student Loan Using AESsucces

I’ll walk you through repaying your loan with AESsuccess (American Education Services), because sorting out student loan repayment options can feel like untangling headphones. Back in the day, I wrestled with my own student loan debt, and let me tell you about different methods for repaying your loan.

Loan repayment is about picking an AESsuccess payment option that fits you, from avoiding default (student loans) to tapping into student loan relief. Use AESsuccess’s tools to conquer student loan debt and keep your higher education financing goals alive.

AESsuccess Payment Options

Let’s dive into how you can make student loan payments with different AESsuccess payment methods. I remember scrambling to pay my loans without pulling my hair out.

I’ll explain: you can log in via AESsuccess org login to hit the online payment portal or send mail payments to the AES AES address for that old-school vibe. Want to set-and-forget?? Go for direct debit (AES) with automated payment service. You can also save bank account information in the AES portal for faster future payments.

Payment’s Options:

- Online: Use AES login to access the student loan portal and pay from your student loan account dashboard.

- Mail: Drop a check for one-time payment instructions.

- Automatic: Set up direct debit to nail payment due dates.

- Extra Payments: Apply overpayments or focus on paying specific loans to shrink your loan payoff amount.

How about an example? My buddy set up standing payment instructions to pay extra on high-interest loans, saving a chunk on interest. Simple. If you’re behind, check amount past due or current due (bill) via student loan payment account login and ping customer service AES for conditional payments advice.

Whether you’re all about digital billing/communications (paperless billing/communications) or mail payments,), AESsuccess makes AES payment (payment application ) smooth. Track your payments (view payment history) to stay sharp with your AESsuccess Paymnet methods.

AESsuccess Payment Processing

Ever wonder how payment processing works with AESsuccess? I’ll explain: your make student loan payments hit your monthly bill (AES), clearing amount past due first, then interest, and finally principal. I once thought overpaying would make me debt-free overnight—75% WRONG. Payments follow a strict order, and payment application (loan) rules keep it tight.

Payment Flow:

- Past Due: Wipes out amount past due.

- Interest/Fees: Covers accrued costs.

- Principal: Lowers your loan payoff amount.

This follows an amortization schedule, spreading payments over time to reduce principal and interest.

Set standing payment instructions or one-time payment instructions via AES login portal. Overpayments or underpayments? AESsuccess adjusts, but conditional payments need customer service AES approval. Simple. Monitor everything with view payment history (AES).

Cool Tip: Sign up for automated payment service to keep payments on point and avoid loan delinquency.

Bottom line? Knowing AESsuccess payment processing information lets you steer your student loan debt without surprises.

AESsuccess Paid Ahead Status

AESsuccess Paid ahead status is a sneaky win, but it tripped me up early on. I’ll explain: extra overpayments cover future monthly bill (AES) amounts, pausing your current due (bill). I thought it meant I was done paying—100% WRONG. It’s a buffer, not a free pass. Check it via AESsuccess login on your student loan account dashboard.

Use direct debit (AES) to push the payment application (loan) forward. Simple. If financial hardship student loans hit, contact customer service AES to tweak your plan. EMI (Equated Monthly Installment) stays manageable with paperless billing/communications alerts.

Cool Tip: Peek at view payment history (AES) to see your paid ahead progress—it’s like a high-five from your future self!

Paid ahead gives breathing room but doesn’t erase student loan debt. Stay on top via AES login portal.

AESsuccess Repayment Plans

Picking AESsuccess repayment plans is like choosing the right gear for a road trip. I’ve sweated over student loan repayment options, and AESsuccess has solid choices. I’ll explain:

- Standard Repayment Plan: Fixed EMI (Equated Monthly Installment) for 10 years.

- Graduated Repayment Plan: Low start, ramps up.

- Extended Repayment Plan (25-year): Smaller payments, longer haul.

- Income-Driven Repayment (IDR): Income-based payments.

- For FFELP loans, Income-Sensitive Repayment adjusts payments based on your income, similar to IDR.

Facing trouble making payments (student loans)? Try deferment, forbearance, or student loan consolidation (federal) for student loan relief. Simple. Log into AESsuccess org login or hit customer service AES to change due date (student loan).

Cool Tip: Use AES login portal for an income-driven repayment (IDR) eligibility quiz—quick and clutch!

For private loans, consider lowering interest rates (via refinance) through a lender, though AES doesn’t directly handle refinancing. While AES focuses on servicing, student loan refinance through external lenders can reduce rates on private loans.

Bottom line? Match your plan to avoid loan default and keep higher education financing on track.

AES Loan Payoff

Paying off your loan early is like nailing a game-winning shot. Your AESsuccess loan payoff amount, shown on a payoff statement, is your total balance plus interest. I rushed a payoff once and missed fees—50% WRONG. Use AESsuccess login to check your student loan account dashboard and grab your AESsuccess Loan payoff option.

Payoff Steps:

- Log into AES login portal.

- Check view payment history (AES).

- Pay via direct debit (AES) or mail payments (AES address).

How about an example? My sister cleared her loan payoff amount early, saving big on interest. Simple. Ask customer service AES about student loan consolidation (federal).

Review your payoff statement monthly for a progress boost—it’s pure motivation! Crush your student loan debt with a smart loan repayment plan via AESsuccess.

What To Do If You Are Struggling Repay?

I’ll explain: struggling with student loan payments is tough, but waiting until you’re drowning in delinquency is 1000% WRONG. Back in the day, I ignored my financial hardship student loans until I was staring at a default—yikes.

AES, your student loan servicer, offers tools like student loan consolidation (general), change due date, reduce payments, and postpone payments to keep you afloat. I’m here to walk you through these options so you can avoid loan default or bankruptcy. Let’s tackle this!

Consolidate Your Loans

Student loan consolidation (federal) simplifies multiple loans into one monthly payment. I consolidated my loans and went from juggling three payments to one—lifesaver. It’s ideal if you’re paying multiple lenders. This process creates Federal Consolidation Loans, streamlining your payments under a single loan with a fixed rate.

Note: private loans don’t qualify, per Department of Education (ED) rules.

Adjust Your Payment Plan

Change due date or reduce payments to fit your budget. I shifted my due date to align with my paycheck—game-changer. Switching to an IDR plan or making interest-only payments can lower your monthly payment. If you can’t pay at all, postpone payments with deferment or forbearance to avoid default.

IDR plans consider your debt-to-income ratio to set affordable payment amounts based on your earnings.

Handling Delinquency, Default, or Bankruptcy

Loan delinquency or default hurts your credit report. I dodged default by applying for loan rehabilitation—tough but worth it. If you’re in default, AES offers recovery options. PHEAA Default Collections works with borrowers to resolve defaults through rehabilitation programs. For bankruptcy, check ED or CFPB for next steps, as loans may not be dischargeable. Use student loan resources to stay informed.

Act before your grace period ends to avoid delinquency, typically six months after leaving school.

Why Act Fast?

Don’t let loans spiral. Missing payments risks loan delinquency, dinging your credit score impact and future borrowing power. I learned this when a late payment hit my credit report—not fun. AES provides free servicer support to prevent default, which can stick around for 7 years (or 10 for bankruptcy).

Options like deferment, forbearance, or income-driven repayment (IDR) can ease financial hardship student loans. Simple. Act now to protect your financial future.

How about an example? You’re tight on cash and miss a payment. Instead of panicking, you log into the AES student loan portal and apply for forbearance to pause payments.

Here’s a pro move: set up alerts and messages (AES) on the AES mobile app to remind you of payment deadlines. I avoided delinquency this way—felt like a financial ninja!

Don’t wait to tackle trouble making payments. Use student loan consolidation (federal), change due date, reduce payments, or postpone payments via AES student loan portal to manage financial hardship student loans.

With student loan advice from CFPB or Department of Education (ED), you’ll sidestep delinquency, default, or bankruptcy and keep your credit score impact positive.

Loan Forgiveness & Discharge Programs Provided By AESsuccess

I’ll walk you through AESsuccess student loan forgiveness programs and student loan discharge with AESsuccess, run by PHEAA (Pennsylvania Higher Education Assistance Agency). Back in the day, I thought forgiveness was a fairy tale. Nope, it’s real and can slash your student loan debt.

Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness reward specific careers, while Total and Permanent Disability (TPD) discharge or closed school discharge cancel loans for hardships. Here’s the catch: only certain federal student loans (general) qualify.

Use AESsuccess org login to check your student loan account dashboard for eligible programs.

Here’s how you do it:

- Log in: Hit AESsuccess login to see your federal student loans (general).

- Check eligibility: Use customer service portal AES for program details.

- Apply: Submit forms via student loan resources or servicer contact.

Unsubsidized Stafford Loans, which accrue interest during school, are also eligible for these forgiveness options. This includes Stafford Loans, which may qualify for programs like PSLF or Teacher Loan Forgiveness. Federal PLUS Loans, available for parents or graduate students, may also qualify for certain discharges or PSLF.

Bottom line? Student loan forgiveness programs and student loan discharge ease higher education financing. Use AESsuccess org login and student loan advice to cut your student loan debt with financial literacy student loans.

Teacher Loan Forgiveness Program

AESsuccess Teacher Loan Forgiveness is a lifesaver for educators. I’ll explain: teach five years in a low-income school, and up to $17,500 of your federal student loans (general), like FFELP loans (Federal Family Loan Program), could vanish. A friend tried this—worked like a charm, but paperwork was intense.

Log into AESsuccess org login to confirm your loans via student loan account dashboard. PHEAA (Pennsylvania Higher Education Assistance Agency) services this, and the Department of Education oversees it. (Check credit report for loan type.)

Here’s how you do it:

- Verify loans: Use AESsuccess login for FFELP loans or student loan consolidation (federal).

- Prove employment: Submit school certification to customer service portal AES.

- Apply: File forms via servicer contact or student loan resources.

This is a cool tip: Keep annual employment records. Lost proof? 90% WRONG.

Teacher Loan Forgiveness reduces student loan debt. Use AESsuccess org login and student loan advice to navigate higher education financing smartly.

Loan Discharge Scheme

AESsuccess Student loan discharge saves you when life gets rough. I’ll explain: closed school discharge, Total and Permanent Disability (TPD) discharge, or deceased borrower/associated individual cancel federal student loans (general) like FFELP loans.

Use AESsuccess org login to check eligibility on your student loan account dashboard. PHEAA processes these via AES login portal. (See Department of Education rules.)

Here’s how you do it:

- Log in: Access AESsuccess login for federal student loans (general).

- Find forms: Use student loan resources for discharge types.

- Submit: Upload proof to AES account access or servicer contact.

Student loan discharge eases higher education financing. Use AESsuccess org login and student loan advice for relief.

Total and Permanent Disability Discharge Scheme

AESsuccess Total and Permanent Disability (TPD) discharge wipes out loans for severe disabilities. I’ll explain: if you can’t work, federal student loans (general) like FFELP loans can be canceled. I helped a colleague with this—tough but life-changing for their student loan debt.

Log into AESsuccess org login to start via student loan account dashboard. PHEAA services this, needing medical proof via AES login portal. (Check Department of Education rules.) How about an example? On disability benefits? Submit doctor’s certification to customer service AES. Simple.

Here’s how you do it:

- Check loans: Use AESsuccess login for federal student loans (general).

- Get proof: Collect medical documents (see student loan resources).

- Apply: Submit via customer service portal AES or servicer contact.

This is a cool tip: Keep document copies. Slow submissions? 80% WRONG.

TPD discharge clears student loan debt. Use AESsuccess org login and student loan advice for higher education financing relief.

Public Service Loan Forgiveness (PSLF) Program

AESsuccess Public Service Loan Forgiveness (PSLF) program is gold for public sector workers. I’ll explain: make 120 qualifying payments in a public service job, and your federal student loans (general) are forgiven. A friend’s plan worked… until paperwork errors hit.

Note that PSLF requires Direct Loans (contrast/comparison) with FFELP loans, which may need consolidation to qualify.

Use AESsuccess org login to track payments on student loan account dashboard. PHEAA services this for the Department of Education. How about an example? Nonprofit worker? Consolidate loans, pay 120 times, apply via AES login portal. Simple.

Here’s how you do it:

- Consolidate: Check AESsuccess login for student loan consolidation (federal).

- Verify job: Submit ECF forms via student loan resources.

- Track payments: Monitor customer service portal AES or servicer contact.

This is a cool tip: File ECFs yearly. Auto-qualifying payments? 95% WRONG.

Bottom line? PSLF erases student loan debt. Use AESsuccess org login and student loan advice for higher education financing success.

Student Loan Discharge Due To Death

AESsuccess death Student loan discharge option is for a deceased borrower and an associated individual is heavy but vital. I’ll explain: if the borrower dies, federal student loans (general) like FFELP loans can be canceled. I helped a family once—tough but cleared their student loan debt.

Log into AESsuccess org login for student loan account dashboard. PHEAA needs a death certificate via AES login portal. (See Department of Education rules.) How about an example? Family submits proof to customer service AES. Simple.

Here’s how you do it:

- Access account: Use AESsuccess login for AES account access.

- Submit proof: Upload death certificate via student loan resources.

- Follow up: Check customer service portal AES or servicer contact.

This is a cool tip: Act fast with documents. Automatic discharge? 1000% WRONG.

Bottom line? Student loan discharge for deceased borrower/associated individual uses AESsuccess org login and student loan advice to ease higher education financing.

Apply For A Refund Using The AESsuccess Platform

I’ll walk you through getting an AESsuccess refund for overpayments on your AES (American Education Services) student loan debt. I once overpaid my monthly bill (AES)—yep, rookie mistake! It’s easy to fix, and I’m here to guide you. Let’s hit the AESsuccess org login and sort your loan repayment.

Step 1: Log In and Spot Overpayments

Go to the AES login portal (aessuccess.org) and use your student loan account login to reach the student loan account dashboard. Back in the day, I botched my AESsuccess login—1000% WRONG. If stuck, check the customer service portal AES. Then, view payment history (AES) to find overpayments or conditional payments.

- Check duplicates: Spot extra direct debit (AES) charges.

- Confirm dates: Verify the payment due date.

How about an example? A double automated payment service charge shows up in your payment history (AES). Simple.

Key Takeaway: Use AESsuccess login to confirm overpayments.

Step 2: Request Your Refund

From the student loan account dashboard, head to customer service AES. I’ll explain: submit a refund request with the current due (bill) and payment application (loan) details. Check paperless billing/communications for a payoff statement. Call the servicer contact for tricky conditional payments.

- Online form: Use AES account access to submit.

- Mail option: Send to the AES contact information update address.

Here’s the catch: be specific to avoid delays.

Key Takeaway: Submit a detailed refund request via the portal.

Step 3: Track the Refund

AES processes refunds fast, crediting your bank or adjusting student loan debt. Monitor via view payment history (AES). Like in this chart: see reversed transactions? Sweet! Check student loan resources if delayed.

Cool Tip: Enable AESsuccess login alerts for refund updates.

Log in, verify overpayments, request via customer service portal AES, and track. With financial literacy student loans, you’ll master higher education financing.

How To Access Tax Information Using AESsuccess Portal

I’ll walk you through accessing AESsuccess tax information like the 1098-E tax form and 1099-C tax form on AES (American Education Services). I’ve fumbled tax season before, missing my student loan interest for taxes deduction—1000% WRONG. Let’s nail this with your AESsuccess org login and boost your manage AES loans online game.

Step 1: Log In to Your Account

Head to the AES login portal (aessuccess.org) and use your student loan account login to hit the student loan account dashboard. Back in the day, I forgot my AES borrower login password—ouch! If you’re stuck, reset it via secure login AES or the customer service portal AES. Once in, check alerts and messages (AES) for tax doc notifications.

- Verify access: Ensure your account number (AES) is correct.

- Update profile: Tweak personal profile AES if needed.

How about an example? A 1098-E tax form alert pops up on your account dashboard/home screen. Simple.

Key Takeaway: Use AESsuccess login to spot tax document alerts.

Step 2: Access Tax Information

Navigate to the view loan details (AES) section to find student loan tax information. I’ll explain: select the 1098-E tax form for interest paid or 1099-C tax form for canceled debt (tax). If you’re on enroll in paperless billing (AES), download them digitally. Otherwise, request mailed copies via update account information (AES).

- Find forms: Check view payment history (AES) for tax data.

- Download: Save forms from AES account access.

Here’s the catch: missing forms? Contact customer service portal AES.

Key Takeaway: Access 1098-E and 1099-C forms in the loan details section.

Step 3: Understand Your Forms

Review your 1098-E tax form for deductible student loan interest for taxes and 1099-C tax form for taxable canceled debt (tax). That’s your deduction! Use check loan balance online to cross-check.

Save forms in your online student loan account for easy tax prep.

Log in, grab your 1098-E tax form or 1099-C tax form, and understand deductions. With AESsuccess login, you’ll ace student loan tax information and access my student loan like a pro.

How To Stay Safe From AESsuccesss Debt Relief Scams?

I’ll explain: falling for debt relief scams is like handing your wallet to a stranger promising to get out of student loan debt. Back in the day, I got a slick email claiming instant student loan forgiveness programs (general)—sounded amazing, but it was 1000% WRONG.

Companies misrepresenting themselves prey on your financial hardship student loans, but your servicer, like AES, offers free support for student loan resources. I’m here to walk you through spotting these scams and sticking with legit student loan advice. Let’s keep your money safe!

What Are Debt Relief Scams?

Scams student loans are sneaky. These outfits pose as helpers, charging you for services AES provides for free, like loan repayment plans or benefits for servicemembers (SCRA). I almost signed up with one claiming ties to the Department of Education (ED), but they didn’t know my loan details—red flag!

They might push taglines like “New Laws Cancel Debt!” or ask for power of attorney (student loans) to mess with your account. Here’s the catch: legit servicers like FedLoan Servicing, Navient, Great Lakes, Nelnet, or MOHELA don’t charge upfront fees.

How about an example? You get a call promising to slash your payments via student loan consolidation (federal). They demand your credit card information and say don’t contact AES. Check their site (imagine a screenshot of a shady disclaimer saying “not affiliated with ED”)—it’s a scam.

How to Spot and Avoid Scams?

Protecting yourself is straightforward. Always verify offers through the AES student loan portal. I learned this after a “debt relief” company asked me to send payments directly to them—huge nope. Stick to student loan resources from AES or the CFPB (Consumer Financial Protection Bureau). Watch for warning signs:

- They claim ties to Department of Education (ED) but lack your loan details.

- They demand third-party fees before helping with teacher loan forgiveness or PSLF.

- They request third-party access (AES) or power of attorney without clear reason.

- They promise instant loan forgiveness or relief from default or wage garnishment.

- They say avoid your lender vs. servicer (AES is your servicer, not lender).

Steps to Stay Safe:

- Log into the AES student loan portal to verify student loan financial aid options.

- Cross-check offers with CFPB or Department of Education (ED) resources.

- Never share credit card information or send payments to third parties.

- Report suspicious activity to AES or CFPB (Consumer Financial Protection Bureau).

- Monitor your credit report for fraud (credit score impact).

AES offers free help for tons of needs. You can explore loan repayment plans, benefits for servicemembers (SCRA), teacher loan forgiveness, or student loan consolidation (federal) without paying a cent. I used AES’s deferment option during a tough spot, and it was a breeze.

Note: student loan consolidation (federal) excludes private loans, and collateral (for secured loans) isn’t relevant for unsecured student loans serviced by AES. The FAFSA (Free Application for Federal Student Aid) site also provides student loan guidance. Notice how you don’t need shady firms?

Bottom line? Don’t fall for debt relief scams promising quick fixes for student loan debt. Use student loan resources from AES, CFPB, or Department of Education (ED) for free support on PSLF, teacher loan forgiveness, or financial hardship student loans.

Stay vigilant against scams student loans by verifying offers and avoiding third-party access (AES) traps. With financial literacy student loans, you’ll keep your credit score impact clean and your loans on track.

AESsuccess Credit Reporting

I’ll explain: understanding credit reporting is like decoding a secret score that shapes your financial life. Back in the day, I ignored my credit score until I applied for a car loan—1000% WRONG move. Your credit score, a number from 300 to 850, reflects how likely you are to repay loans on time.

student loan servicer, AES reports your student loan status monthly, impacting your credit report. I’m here to walk you through what this means and how to manage it, including credit disputes. Let’s dive in!

Understanding Credit Score

Your credit score matters. A high score (closer to 850) screams “I pay on time!” and can snag you better interest rates or loan terms. I once saw my score dip after missing a student loan payment—ouch.

AES reports your loan payment history to consumer reporting agencies, showing if you’re on track or slipping into delinquency or default. Good habits, like timely payments, boost your credit score impact, while late payments or default can haunt your credit report for 7 years (bankruptcies, 10 years!).

How about an example? You make regular student loan payments via the AES student loan portal. Your credit report shows consistent payments, lifting your credit score. See this chart: (imagine a graph of score improvement over time).

Credit Reports vs. Credit Scores

Credit reports aren’t credit scores. Your credit report is a detailed record of your credit activity, like student loans, credit cards, or mortgages, including payment history and account status.

Your credit score crunches this data into a number. AES updates your credit report monthly, reflecting fully repaid accounts or delinquent accounts. I learned this when a late payment showed up on my credit report—not fun.

Handling Credit Disputes

Credit disputes fix errors. I once spotted a wrong late payment on my credit report and filed a dispute—saved my score! If AES reports inaccurate student loan status, submit a credit dispute via the AES customer service portal or directly to consumer reporting agencies.

You’ll need your account number, dispute details, and supporting documents. Mail disputes to AES Credit, P.O. Box 61047, Harrisburg, PA 17106-1047, or use the direct credit dispute form.

Steps to File a Credit Dispute:

- Sign into Account Access to get your account number.

- Identify errors in credit report (e.g., incorrect delinquent accounts).

- Submit a credit dispute online via AES student loan portal or mail the direct credit dispute form.

- Include loan payment history proof and dispute details.

- Check resolution status with CFPB or Department of Education (ED).

In some cases, you may request goodwill retractions (credit) for minor errors if AES approves.AES may also offer courtesy adjustments (credit) to correct reporting errors without formal disputes.

Here’s a slick trick: set alerts and messages (AES) to ping you for student loan payment due dates. I did this and dodged a late payment that could’ve tanked my credit score—like a financial superhero move.

Credit reporting shapes your financial future. Monitor your credit score and credit report via the AES student loan portal, keep loan payment history clean to avoid delinquency, and file credit disputes for errors.

With financial literacy student loans, you’ll manage credit score impact like a pro, steering clear of default and boosting your student loan resources.

About AESsuccess

AESsuccess, operated by PHEAA (Pennsylvania Higher Education Assistance Agency), is your lifeline for student loan account management. My first AESsuccess login opened a toolbox for managing student loan debt—I was sold!

Using AESsuccess org login, you access the student loan account dashboard to handle federal student loans (general) like FFELP loans (Federal Family Loan Program) or private loans. AES makes higher education financing manageable with free servicer support. I avoided loan delinquency by applying for deferment (student loans) via the AES student loan portal—a total win!

Here’s what AESsuccess offers:

- Easy Access: Log in via AES login portal or AES mobile app with Touch ID login AES to check loan balance online.

- Payment Tools: Use direct debit (AES) or enroll in paperless billing (AES) to streamline payment history (AES).

- Relief Options: Explore student loan consolidation (federal), income-driven repayment (IDR), or student loan forgiveness programs like PSLF (Public Service Loan Forgiveness).

- Support: Contact customer service AES (1-800-233-0557) for credit disputes or loan rehabilitation program (FFELP default).

- Security: Avoid scams student loans with verified student loan resources from Department of Education (ED).

AES reports loan payment history to consumer reporting agencies, impacting your credit score impact. I once clicked a fake login—1000% wrong! Stick to AESsuccess org login to stay safe.

Whether you’re updating account authorizations (AES), seeking student loan discharge, or managing financial hardship student loans, AESsuccess simplifies student loan financial aid. Dive into the AES student loan portal to take charge of your student loan debt!

Frequently Asked Questions(FAQs) On AESsuccess Login

Got questions about managing your AES student loans? I’ll answer the top queries to help you navigate AESsuccess org login and student loan account management like a pro.

Is AES Services a private or federal loan?

AESuccess services both federal student loans (general) like FFELP loans (Federal Family Loan Program), and private loans, depending on your lender.

What is the phone number for AES Customer Service?

The Phone number of AESesuccess Customer support is 1-800-233-0557, on this number support is available from Monday–Friday, 7:30 AM–9:00 PM ET.

What are AES services?

AES provides services like Student loan management, and offers tools for quick account management, student loan consolidation (federal), and student loan forgiveness

Can AES loans be forgiven?

Yes, AESsuccess student loans can be forgiven if you are eligible for the forgiveness programs like, PSLF (Public Service Loan Forgiveness) or Teacher Loan Forgiveness.

How can you pay AES?

You can pay AESuccess using multiple options like, pay online, direct debit (AES), automated payment service, mail, and by phone.

I can’t afford my full payment amount. What are my options?

If you can’t afford the full payment amount, you can apply for income-driven repayment, deferment, or forbearance to manage financial hardship student loans.

Am I eligible for a deferment or forbearance?

If you are wondering about your eligibility for the deferment or forbearance in your loan, then check your eligibility on the AESsuccess.org in trouble paying section.

Can I change my due date in AESsuccess?

Yes, you can change your payment due date by logging into your AES account .

Should I pay for assistance with my federal student loans?

No, you should never pay for assistance with your federal student loans. AESsuccess offers free servicer support for student loan consolidation (federal) or PSLF. Avoid scams student loans by sticking to Department of Education (ED) resources.

These FAQs cover everything from AESsuccess login to student loan forgiveness programs, making student loan debt management straightforward with AES student loan portal tools.

Conclusion

With AESsuccess login, you’re ready to tackle student loan account management. I once got locked out of my account, panicking over a missed payment—1000% wrong move! I’ve walked you through logging in, managing your account, fixing issues, staying secure, handling payments, and exploring student loan forgiveness programs.

You’ll dodge scams student loans, ease financial hardship student loans, and monitor credit score impact with student loan resources. Use AESsuccess org login to check balances, update details, or apply for student loan consolidation (general). Log into AESsuccess login and take control of your student loan debt like a pro!